EV Estimates

November 20, 2020

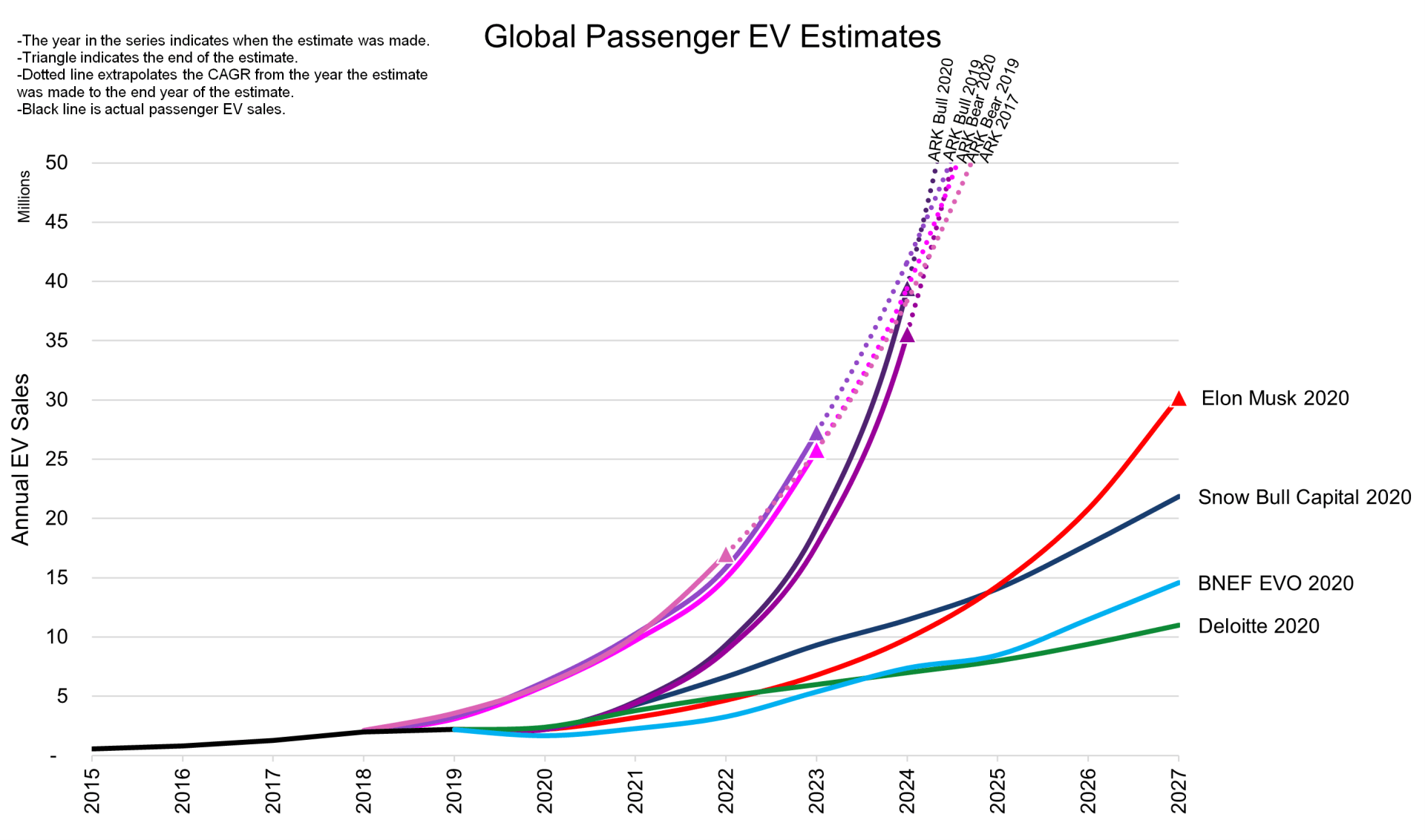

Mass adoption of EVs, along with the emergence of new EV companies, will mark 2021 as the true beginning of the global shift to transportation electrification. We are sharing our EV estimates out to 2040.

While we were hesitant to project so far out, recent changes have rendered a more realistic outlook. Estimates of this scale require millions of data points and months of modeling. Based on recent national EV targets, li-ion battery price reductions & a clear shift to LFP batteries, promising new entrants to the EV space, public charging infrastructure build outs, and a general consumer shift to EVs, estimating 20 years out isn’t as unreasonable as it has been.

The first chart and the last chart are interactive. Select/deselect the series in the legend to show/hide.

Tesla

We have also broken down Tesla’s sales by model based on current timelines for future product rollouts. In the long-term, the lower-priced models (3/Y/$25k model) will be Tesla’s best-selling. Cybertruck will be relatively short-lived–we just cannot see it being a long-term player in the relatively few pickup truck markets, especially as electric pickup trucks from Ford, GM, Rivian, Lordstown, etc. roll out. We see Cybertruck sales peaking in 2027 at 206,000, and falling sharply thereafter. Roadster will be too expensive to make up any meaningful sales, especially as competitors roll out more electric supercars, even in the next few years. Model S and X are already becoming less popular due to the cannibalization from 3 and Y, and a $25k model will only contribute to this decline. Model Y will soon become more popular than Model 3, and the $25k model will become the most popular Tesla model within the first three quarters of its launch. As Tesla brings costs down to produce more cars for the masses, its higher-end model sales will be eclipsed.

A $25k Tesla will be significantly more important over the next decade than its robotaxi fleet. Many estimates assume Tesla’s robotaxi fleet will be deployed as early as next year. The Full Self-Driving beta was released to a handful of Tesla owners last month, and it is already showing how long Tesla still has to go before achieving L4/5, if it's at all possible. Even if Tesla launches robotaxi software next year, it will still undoubtedly require a human driver in the vehicle (L3). Tesla owners may use their own cars for ride-hailing, but fleets of fully autonomous vehicles are years away, and Tesla won’t be the only company to deploy them.

Stay tuned for more company-specific estimates, as well as commercial EV estimates, which will be most meaningful to a cleaner future.