Chinese EV Stocks’ Recent Surge, Visualized

November 12, 2020

Over the past six years, the rankings of the largest automakers by market capitalization have shifted, especially recently as EVs have gained traction. The data in the interactive data visualizations below are all the same, but are shown five different ways.

As you may notice from the first visual, the usual suspects lead the pack in 2015 – Volkswagen, Toyota, Daimler, BMW, Ford, General Motors, and Honda.

You may notice three of the top five most valuable automakers today primarily sell EVs. While EVs only account for less than 3% of new car sales globally, their valuations have recently soared. Tesla, BYD, NIO, and Xpeng, which make majority (if not all) EVs, have risen to the top of the rankings, while traditional internal combustion engine (ICE) makers, such as Ford, Honda, and GM, continue to sink lower. This is indicative and representative of the overall shift to EVs, and the market’s realization of this shift.

Notably, Tesla began its surge to the top in 2020. The four other automakers primarily producing EVs (BYD, NIO, XPeng, Li Auto) currently among the top 25 have recently surged in rank. In June 2020, NIO was the 22nd most valuable automaker, and BYD was the 14th. Xpeng and Li Auto weren’t even public yet. Today, BYD and NIO are the 4th and 5th most valuable automakers, respectively, and Xpeng and Li Auto are already the 12th and 16th most valuable automakers, respectively.

NIO has been public for just over two years, and is already the world’s 5th largest automaker in terms of market cap. Chinese automakers continue to creep up in the rankings, which is unsurprising given the increasing amount of EV companies starting to bear fruit in China.

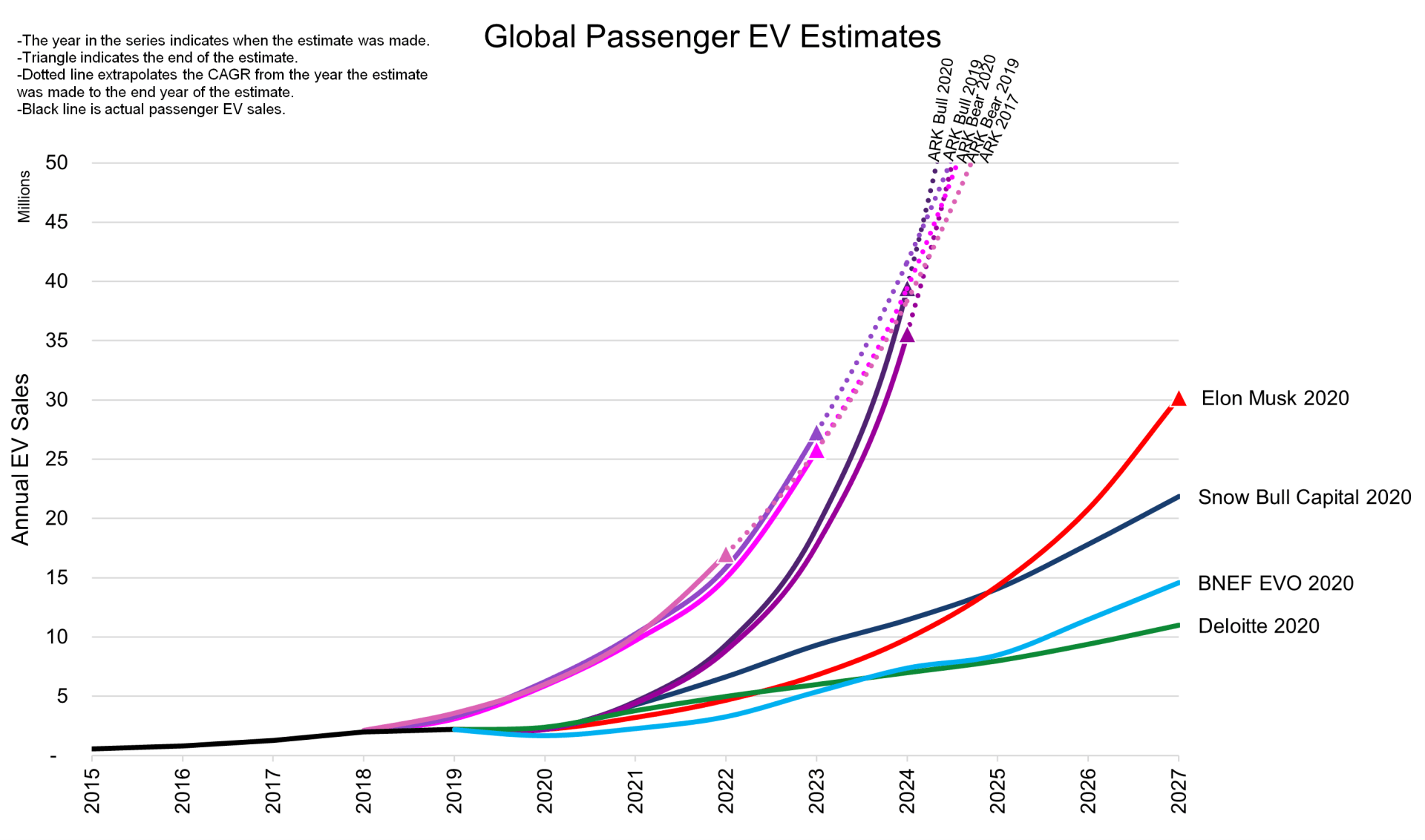

Battery pack prices have plummeted over the last five years. It is cheaper to manufacture EVs than ICE vehicles.

According to BNEF, battery prices have fallen from an average of $373/kWh in 2015 to as low as $85/kWh today. Prices will continue to fall as production ramps up, through economies of scale, and with new technological breakthroughs and innovations.

Four of the five EV companies on this list are Chinese.

Investors have realized that EVs are the future, as have China’s EV companies. Electric vehicles are here to stay; no longer is that disputed. Traditional automakers need to accelerate their transitions from ICE vehicles to EVs; they are already being left behind. 2020 has been an especially transformative year for EV makers, and this is just the beginning. The "rising tide lifts all boats" phenomenon in the EV space has been led by Tesla, but it is no longer a winner-take-all scenario, and Chinese EV companies with weaker brand recognition in the West are only getting stronger. There is no limit to the number of winners in the race to make the planet more sustainable.